Company Announces Delay in Issuance of 2006 10K

My Concerns were validated with today's SEC filing. On March 8th I mentioned my concern about the delay in the 2006 proved reserves report when it was stated, "...Investors are left wondering why such a delay in the 2006 reserve report. Are there problems?"

Here is the narrative from the 10NT (A filing to alert the SEC that the 10K will be late):

"Arena Resources, Inc. has engaged an independent petroleum engineering consultant to aid in the preparation of the Company's estimated quantities of oil and natural gas reserves and the related discounted present value of future pre-tax cash flows and standardized measure of discounted future net cash flows therefrom ("Reserve Estimate"). The Reserve Estimate will not be completed in time to enable the Company to complete all of the disclosure required in its Annual Report on Form 10-K..."

Clearly this is a red flag. The question that needs to be asked is 'why is the reserve report late?' There is absolutely positively no excuse. GMXR was criticized for its tardy 10K reports. ARD does not get a free pass. There better be some good reasons for the problem and assurance that it will not happen again.

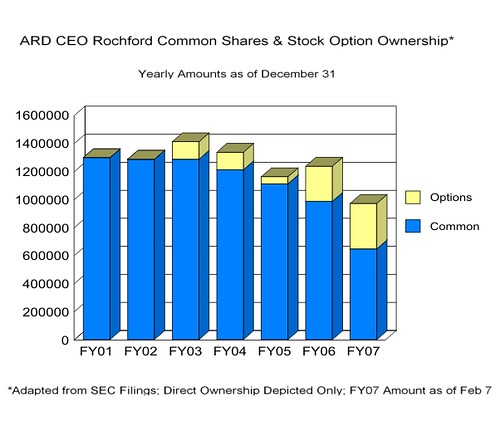

Maybe we should ask management to give back the stock options that were awarded for 2006 for poor performance in getting the 10K submitted on time. The jury is out until we hear from management. This just seems so uncharacteristic of a Tim Rochford company to be late on an SEC filing. The company has been perfect in on-time performance since company inception back in 2001.

I'm left wondering if Tim Rochford has some health issues/problems. Is this a reason why he created the position of COO for Phil Terry? Given the fact that Tim is so meticulous in his managment style I"m left wondering if he relinquished day to day control of the company to someone ill-prepared to handle the task as a result of some health problems.

I have no information indicating that Tim had any recent health problems but this is the only thing that I can come up with. The other scenario would be some serious problems with the Fuhrman-Masscho property as it relates to the natural declines. In the Q3'06 conference call there was mention of secondary recovery techniques being utilized on the new wells being drilled. Could this fact coupled with some large natural decline rates have painted a grim picture in the mind of the independent petroleum engineering consultant? Maybe the final results of the petroleum engineer were not to the liking of ARD management. Maybe ARD decided to take the time to get a second opinion in order to challenge the initial report? While both of these scenarios are serious they can not be dismissed by investors at this time. I would expect ARD shares to decline in trading on Monday by a significant amount.